How to Sell Products on Amazon as a Non-US citizen

In fact, of Amazon’s 2.2 million third-party sellers worldwide, 86% sell in the U.S. marketplace — and 41% aren’t even located in the U.S. If you’re interested in becoming a seller on Amazon’s U.S. platform, but don’t live in America, this piece will teach you how to start selling by selecting your preferred type of account status, business entity, available markets. By the end of the article, you can learn what documents, cost you need to prepare in the process, and how to go global to sell your listings.

In fact of Amazon’s 2.2 million third-party sellers worldwide, 86% sell in the U.S. marketplace, and 41% are even not located in the U.S.

You’re interested in becoming a seller on Amazon’s U.S. platform, but you don’t live in America. It might require more preparation. This piece will teach you how to start selling by selecting your preferred type of account status, business entity, and available markets. By the end of the article, you can learn what documents, and the cost you need to prepare in the process. You can master how to go global to sell your listings.

Non-US Sellers on Amazon & Fulfillment by Non-US Merchants (or Sellers)

You don’t need to be a United States citizen to sell on Amazon. But once your transactions reach 50 items on the marketplace, you’ll need to have a proper tax id.

Regardless of the type of account, if you want to open, a non-citizen of the United States will typically have very some requirements. These requirements are similar to citizens or residents of the country in order to sell on Amazon. You need to obtain your FEIN. FEIN is short for Federal Employer Identification Number.

You can obtain your FEIN number by filling out Form SS-4, as the IRS provides it. You don’t need to have any legal status in the country in order to get this number. Once you have the number you can sell products on Amazon as an individual, instead of registering your business. If you’re registering a business, then you should wait to get your FEIN through that process.

Non-US Sellers on Amazon & Fulfillment by Amazon or FBA

However, if you’re not a resident of the United States, it requires additional info if you want to sell through Amazon’s FBA or Fulfillment By Amazon program. You’ll need the following information in order to register an FBA account, regardless of the individual or business account.

- Your Home or Business Address in the US: A place where you can receive personal mail.

- Email Address: An address Amazon can send important information about your account.

- Credit Card: An internationally chargeable credit card with a valid billing address.

- Phone Number: This will be needed to verify your identification during registration.

- United States Tax ID: Either a social security number for individual sellers only or a FEIN number.

- Bank Information: You’ll need a bank that can take an ACH or automated clearing house payment from Amazon. If you’re unable to open a U.S. bank account, you may need to use Amazon’s Currency Converter for sellers. It will allow you to sell on Amazon without opening a U.S. bank account.

Additionally, if there are states where you have a tax nexus. It requires you to include your state tax id in all of those states. If you’re not residing in the country, this will only apply to any business selling on Amazon you may have in specific states.

What Types of US Legal Business Entities You Can Create

Currently, if you’re not a citizen or a resident of the United States, you can only create two types of legal business entities. One is an LLC or limited liability company. And the other is a C-Corp or corporation.

Limited Liability Company

A Limited Liability Company can be best described as a hybrid between a corporation and a partnership. It provides easy management and “pass-through” taxation. They are the profits and losses that are added to the owner’s personal tax returns. It’s like a Sole Proprietorship and Partnership, with the liability protection of a Corporation. It’s a relatively new form of business created in 1977 in Wyoming and now recognized in all 50 States and D.C.

Like a corporation, it is a separate legal entity. Unlike a corporation, there is no stock and there are fewer formalities. The owners of an LLC are called Members instead of Shareholders. So in essence, it’s like a corporation, with less complicated taxation and stock formalities.

The heart of a Limited Liability Company is known as the Operating Agreement. This document sets the rules for operating the company and can be modified as the business grows and changes.

LCC Pros and Cons

Operating an LLC is less formal than a corporation. It usually only requires an Annual Members’ Meeting and Members’ agreeing to changes to the Operating Agreement and other major company decisions.

PROS: It provides the liability protection of a corporation without the corporate formalities, such as Board meetings, Shareholder meetings, minutes, etc. Also, it provides extra levels of management, such as Shareholders, Directors, and Officers. Taxed the same as a sole proprietorship or 1 Member LLC. Or it’s a partnership or 2 or more Members.

CONS: It’s usually more expensive to form than a DBA, and it requires more paperwork and formal behavior.

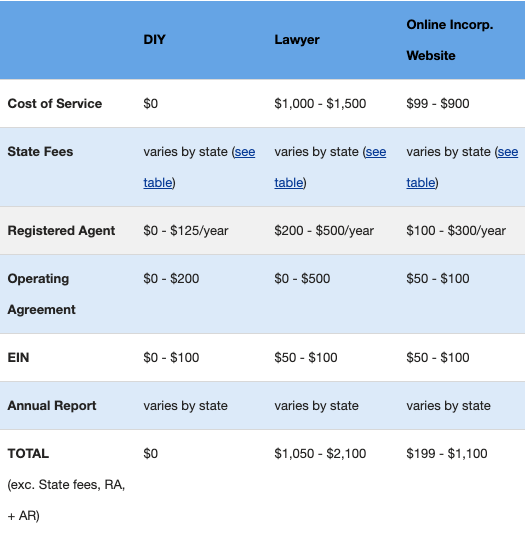

How much to cost to start an LLC

Regular Corporation (C-Corporation)

A corporation is a separate legal entity that can shield the owners from personal liability and company debt. As a separate entity, it can buy real estate, or enter into contracts. It can sue, and be sued completely separately. Also, it can raise money easier via the sale of stock. It can transfer its ownership via the transfer of stock. The duration of the corporation is perpetual because the business can continue regardless of ownership). The tax advantages can be considerable. For example, you are able to deduct many business expenses, healthcare programs, etc. These are other legal entities that are not. Income is reported completely separately via a tax return for the corporation.

A corporation is set up in this structure:

- Shareholders own the stock of the corporation.

- Shareholders elect Directors (known as the “Board of Directors”).

- Directors appoint Officers (President, Secretary, Treasurer, etc.).

- Officers run the company (day-to-day operations).

In many cases especially during the startup phase, you will be the 100% owner of the stock. Therefore you elect the directors. It’s usually yourself. And then you appoint yourself as an officer or all the officers. They are such as the CEO, Treasurer, Secretary. You set the rules for operating your corporation. Normally we call it Corporate Bylaws. This document sets the rules for the company and you can modify them, as the business grows and changes.

C-Corporation Pros and Cons

Operating a corporation involves at the minimum holding a yearly Directors and Shareholders meeting (the location is determined by you and the expenses are deductible). It keeps minutes of major company decisions and maintains general corporate compliance as dictated by the Corporate Bylaws.

PROS: The oldest, most successful, and most prestigious type of business entity. It provides personal liability protection. It conveys permanence, and it can reduce taxes (lower tax rate on retained profits, items like healthcare, travel, and entertainment are deductible).

CONS: More expensive to set up than an LLC. It requires more paperwork and formality required than an LLC, such as holding Shareholder/Board meetings, and keeping minutes and resolutions.

Choose your Business Model to Sell Products on Amazon

You may already have an idea of what products you’d like to sell. But if you don’t, there are great ways to learn high-demand, low-competition product opportunities in the U.S. market.

After Amazon approves you as a seller in the U.S. marketplace, you will first need to determine which business or sales model you plan to use.

These are the three most popular business models for international Amazon U.S. sellers:

- Private Label: Creating your own brand, and label in order to manufacture your own products. While it involves somehow more than the other business models, it’s by far the most popular. 71% of all Amazon sellers are private label sellers.

- Wholesale: Purchasing bulk goods to resell on Amazon. Unlike a private label, a seller must not create their own brand. The seller merchandises from other brands/companies and sells them on Amazon.

- Dropshipping: Another supplier or manufacturer offers you the product to sell and promote. When you generate the sale, the drop shipper pays the supplier and manufacturer to ship the products on your behalf.

OEM, Private Label, White Label or Dropshipping? Tips of Product Sourcing for the eCommerce Store

While other business models exist, logistically, these three are the easiest since they all require little to handle on your part. You can sell these types of products on Amazon without ever actually seeing the inventory yourself.

Conversely, business models like retail arbitrage require you to source the products in person, then ship those goods to Amazon. This could end up being costly.

Choose a Customs Broker

In order to import your item into the U.S., you will need a customs broker to get your product into the country. Unless you ship via air like UPS, DHL, or FedEx. In this case, the service includes that.

Your customs broker will guide you through the exact process of clearing your shipment. It includes the requisite paperwork, documentation, taxes, and more. This is perhaps the least enviable aspect of selling on Amazon’s U.S. store, but something that all importers have to go through.

We recommend using a customs broker like Flexport. It can handle all the customs, freight forwarding, and inventory storage for you. You can find alternative customs brokers with a quick Google search for contact details and reviews.

Which Countries’ Citizens Can Sell Products on Amazon U.S.?

Currently, Amazon U.S. accepts sellers from 102 countries around the world. You can view the entire list of accepted countries in Amazon’s help center.

According to Amazon rules, a seller will need to have proof of residence in their home country as well as a valid phone number and internationally chargeable credit card. It proves you are eligible to sell in that country on Amazon.

What Countries and Marketplaces You Can Sell Products on Amazon and How?

I mentioned in the other article about Niche Product-driven Strategy Is Not Enough? 7 Secrets to Amazon Marketing Success. There are more than 180 countries and 12 marketplaces you can sell through the Amazon seller center. It’s very easy to kick off the Go Global Selling activities.

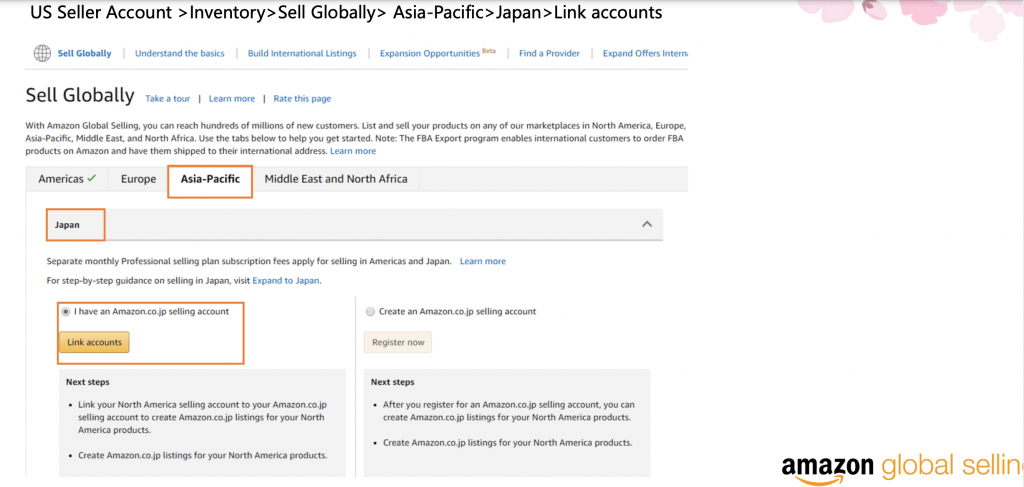

Take Japan for an example, you can link your North American selling account to your Amazon.co.jp selling account. It’s for you to create Amazon.co.jp listings for your North America Products.

I hope you enjoy reading about how to sell products on Amazon as a Non-US citizen. if you did, please support us by doing one of the things listed below, because it always helps out our channel.

- Support my channel through PayPal (paypal.me/Easy2digital)

- Subscribe to my channel and turn on the notification bell Easy2Digital Youtube channel.

- Follow and like my page Easy2Digital Facebook page

- Share the article to your social network with the hashtag #easy2digital

- Buy products with Easy2Digital 10% OFF Discount code (Easy2DigitalNewBuyers2021)

- You sign up for our weekly newsletter to receive Easy2Digital latest articles, videos, and discount code on Buyfromlo products and digital software

- Subscribe to our monthly membership through Patreon to enjoy exclusive benefits (www.patreon.com/louisludigital)

If you are interested in how to sell in Japan as a non-Japan citizen, please check out this article

Which Is Better for Non-Japan Citizen Sellers? Rakuten Ichiba vs Amazon Japan