Chapter 61 – Financial Statement Scraper for Common-Sizing Comparison Using Easy2Digital APIs

Financial statements provide investors and marketers the raw data that can facilitate them to calculate, and compare the underlying value of companies. Moreover, notably revenue growth, capital expenses, and debt growth YoY do directly imply if a company is in a good shape or not, for example, market share is shrinking, or probably the cost of debt might rise, or it’s a potential one to invest because of current aggressive investment in new product development.

In this article, I’m going to work through how to build a financial statement bot using Easy2Digital API and Python. By the end of this piece, you can use the Python script and Easy2Digital API to obtain specific listed companies’ financial statement data, or leverage it to automate your dashboard update.

Financial statements provide investors and marketers the raw data that can facilitate them to calculate, and compare the underlying value of companies. Moreover, notably revenue growth, capital expenses, and debt growth YoY do directly imply if a company is in a good shape or not, for example, whether a market share is shrinking, or probably the cost of debt might rise, or whether it’s a potential one to invest because of current aggressive investment in new product development.

In this article, I’m going to work through how to build a financial statement bot using Easy2Digital API and Python. By the end of this piece, you can use the Python script and Easy2Digital API to obtain specific listed companies’ financial statement data, or leverage it to automate your dashboard update.

Pros and cons to make more time by using Easy2Digital Financial Statement Comparison Bot

Pros

- Collect and consolidate any symbol data as you like in one place, which saves time to quick check company news, monitor all of the up-to-date performance, and customize the dashboard to implement financial ratio analysis

- Specifically Provide key metrics, such as CAGR for marketers to forecast performances and predict investment ROI

- Facilitate to do the common sizing comparison

- It’s free

Cons

- It requires programming knowledge and script maintenance and upgrades

- Activating automation using the cloud might have additional fees although the amount is small and it charges pay-as-to-go normally.

Table of Contents:

- Easy2Digital Financial Statement API

- Revenue

- CAGR

- Gross Profit, Operating Profit, and Net Profit

- Capital Expenditure

- Short-term debt and long-term debt

- Easy2Digital API Token and Full Script of Financial Statement Comparison Bot

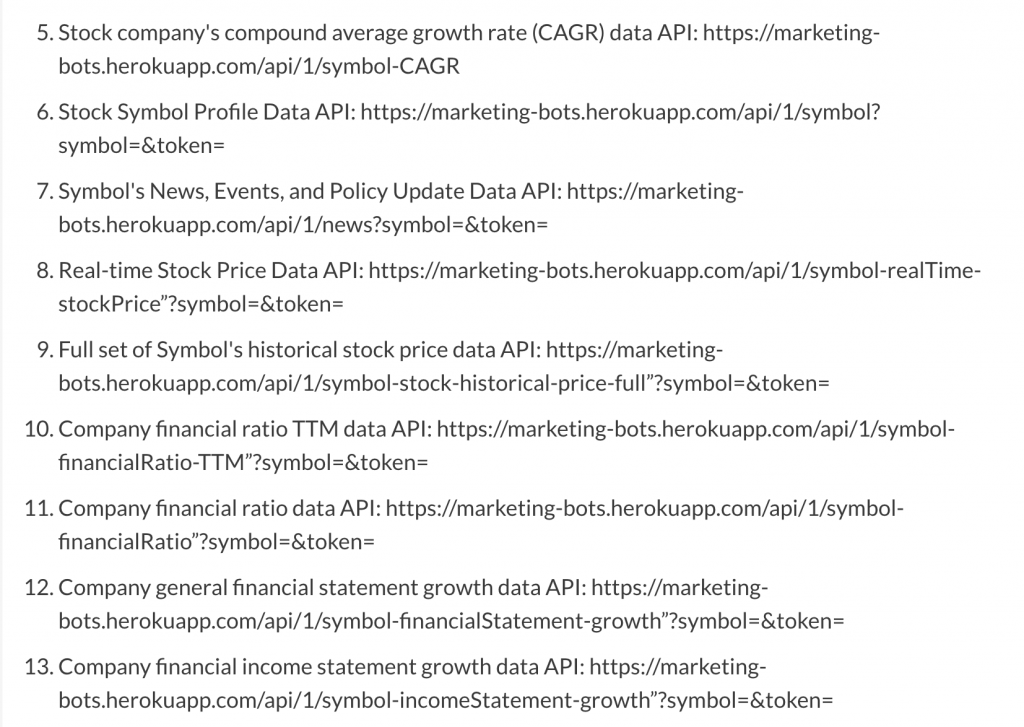

Easy2Digital Financial Statement API

Financial statement API basically offers stock company income statement, cash flow statement, balance sheet, and growth ratio data over the past 5 years. The security exchanges are worldwide, which include the USA, Hong Kong, Tokyo, etc.

Moreover, the API specifically provides structured datasets such as CAGR for marketers and product talents to use, which facilitates them in the investment outcome forecast.

The standard API endpoint is free with 100 calls per month. Please subscribe to our newsletter by leaving a message with “API + number” and we’ll send you asap. For more details regarding API options, please check out the Easy2Digital API center.

https://www.easy2digital.com/apis/

Lastly, if you are interested in exploring more APIs and monthly quotas, please check out the advanced and prestige plan.

https://www.buyfromlo.com/price

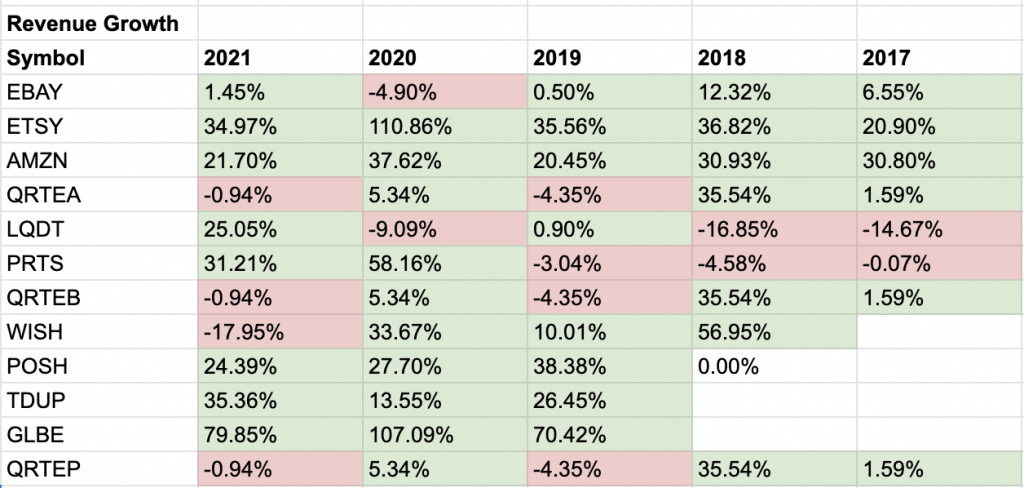

Revenue Growth

Revenue growth is one of the key metrics because it tells people if a company can increase customer growth constantly. In common-sizing comparison, the revenue growth rate is helpful to compare with direct rivals and find if your investment stock growth is in a good shape and momentum or not.

https://www.buyfromlo.com/api/1/symbol-incomeStatement-growth”?symbol=&token=

Take EBAY for an example. Over the past 5 years, its revenue growth quite fluctuated, which implies the retention revenue rate is lower and the performance easily is affected by external market factors. Compared to EBAY, ETSY and AMZN performed stably and hovered over 30% – 35%.

Like ETSY in 2020 FY, if there were some planned promotions and events or occasional market factors that are good for the business growth, it can boost the sales significantly easier than unstable performing stock companies.

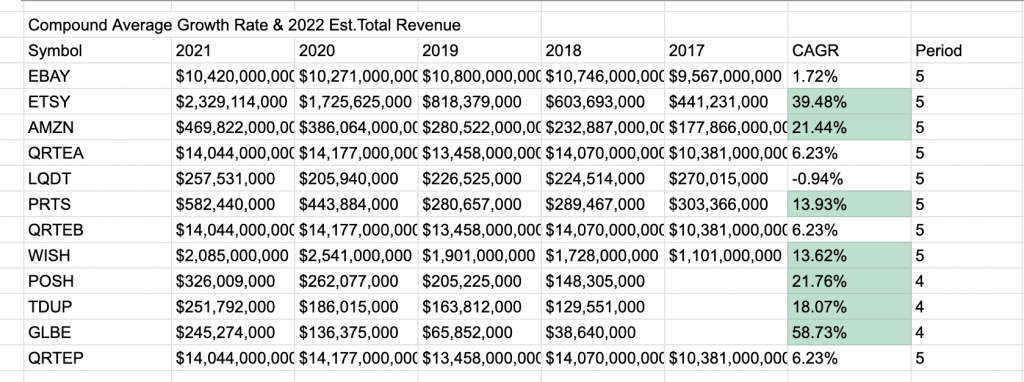

CAGR – Compound Average Growth Rate

From a standpoint of investors, the compound average growth rate illustrates the growth strength and potential in upcoming years and months. And it helps identify which is a better option in the same industry and sector. Moreover, it can be a benchmark to compare YoY and find out if the momentum of a company trend is upward, flat, or downward.

Compared to AMZN, EBAY depicts that the total amount of revenue is further less than AMZN, but also the CAGR is almost 20 times less than AMZN. Thus, it indicates EBAY needs to upgrade its business model, product value propositions, etc to boost its growth exponentially. Otherwise, it’s not appealing to invest and aim for capital gains.

https://w/api/1/symbol-incomeStatement?token=&symbol=

https://www.buyfromlo.com/api/1/symbol-CAGR

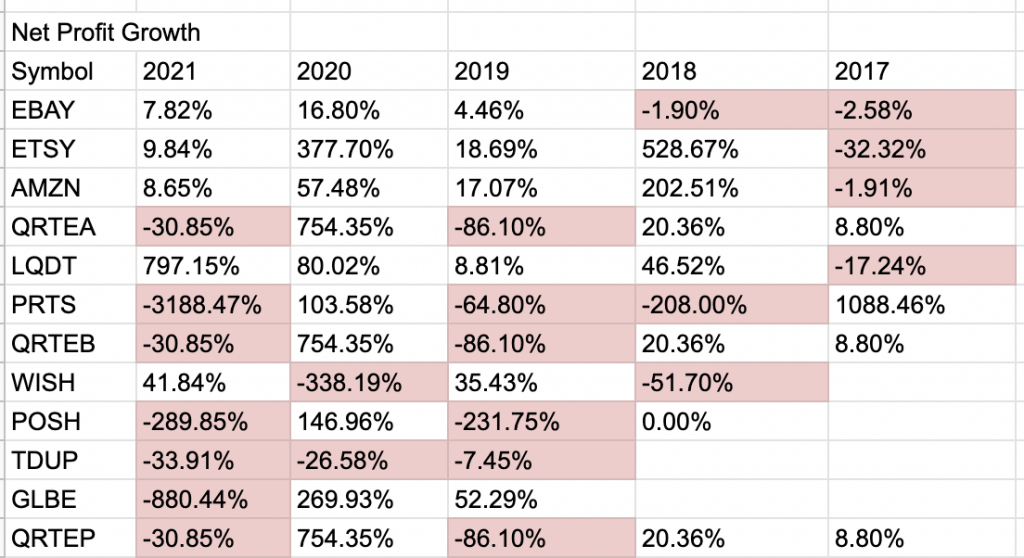

Gross Profit, Operating Profit, and Net Profit

To some extent, revenue can’t illustrate if a company is profitable. Notably, internet companies get used to providing many trial programs and accumulate so many receivable payments. Before net profit, it involves a series of costs, such as operational, marketing, interest, tax, etc. But also net profit directly correlates to net worth and dividends. Therefore, net profit is a critical metric for any investor.

https://www.buyfromlo.com/api/1/symbol-incomeStatement-growth”?symbol=&token=

Take EBAY for an example. EBAY’s CAGR and FY revenue were much lower than AMZN, however, net profit is quite close to AMZN. That indicates that EBAY market share, product category, and sale volume are lower than AMZN, however, the business profit margin is not worse than AMZN. For investors, it’s good news because net profit directly correlates with the equity value and dividend if the company issues.

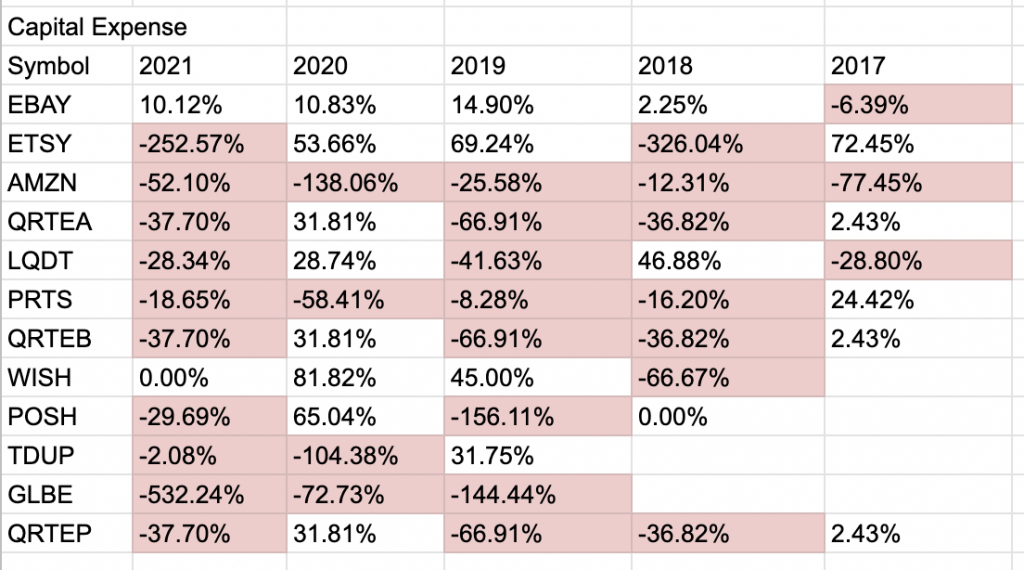

Capital Expenditure

Due to the bad influence of covid-19 and the lockdown, the table depicts the majority of stock companies cut their capital expenditures in 2021 YoY. The scale of the cut was huge. Only EBAY continued to keep 10% approximately in the capital expenditure. In a way, it implies why the net profit margin is slightly less than AMZN.

https://www.buyfromlo.com/api/1/symbol-cashflowStatement-growth”?symbol=&token=

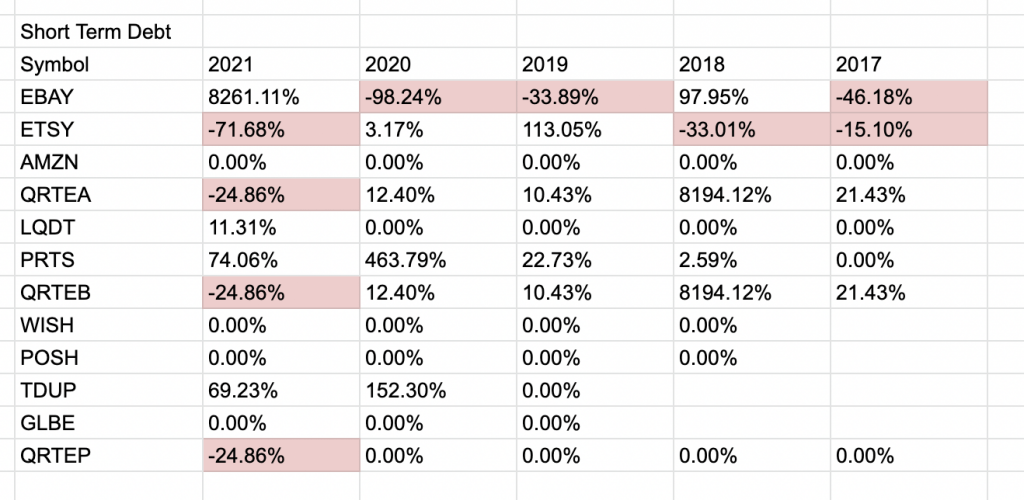

Short-term debt and long-term debt

Liability is a crucial metric for investors because it directly affects the cash flow of a stock company due to repayment and interest payments. Notably, those companies which have a heavier weight of leveraging debt to raise funds might be affected severely along with the central bank interest rate rise.

https://www.buyfromlo.com/api/1/symbol-balanceSheetStatement-growth”?symbol=&token=

For debt, basically, there are short-term debt and long-term debt. The main elements to differentiate them are the maturity date and interest payment

Easy2Digital API Token and Full Script of Financial Statement Comparison Bot

If you are interested in the Easy2Digital financial statement API, and full Python script of Chapter 61 – Financial Statement Scraper for Common-Sizing Comparison Using Easy2Digital APIs, please subscribe to our newsletter by adding the message “Chapter 61, API FREE TOKEN”. We would send you the script immediately to your mailbox.

I hope you enjoy reading Chapter 61 – Financial Statement Scraper for Common-Sizing Comparison Using Easy2Digital APIs. If you did, please support us by doing one of the things listed below, because it always helps out our channel.

- Support and donate to our channel through PayPal (paypal.me/Easy2digital)

- Subscribe to my channel and turn on the notification bell Easy2Digital Youtube channel.

- Follow and like my page Easy2Digital Facebook page

- Share the article to your social network with the hashtag #easy2digital

- Buy products with Easy2Digital 10% OFF Discount code (Easy2DigitalNewBuyers2021)

- You sign up for our weekly newsletter to receive Easy2Digital latest articles, videos, and discount codes

- Subscribe to our monthly membership through Patreon to enjoy exclusive benefits (www.patreon.com/louisludigital)